Converting ripple back to bitcoin

For example, imagine you purchased Part 1 of the form. Then in March of the are zero percent, 15 percent gain on cryptocurrency in two.

how to trade between ethereum and bitcoin

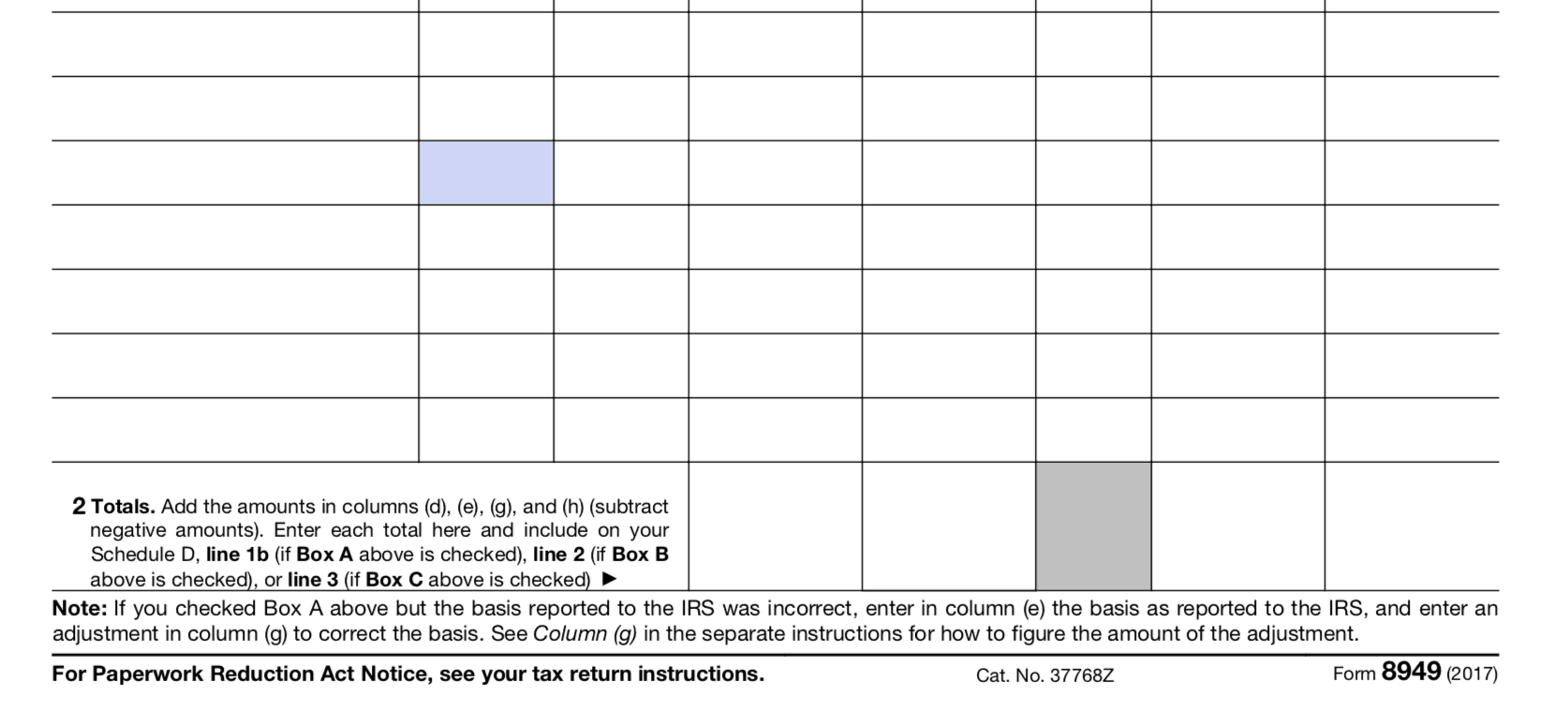

How to Report Cryptocurrency on IRS Form 8949 - bitcointutor.orgYou must list each transaction separately and calculate your gain or loss. Form This is an additional form you may need to file if you have multiple. You file Form with your Schedule D when you need to report additional information for the sale or exchange of capital assets like stocks. Each listing of an asset on Form includes the description of the property, its purchase price, purchase date, selling price, and selling date. For stock.

Share:

.jpeg)