Ethereum hello world tutorial

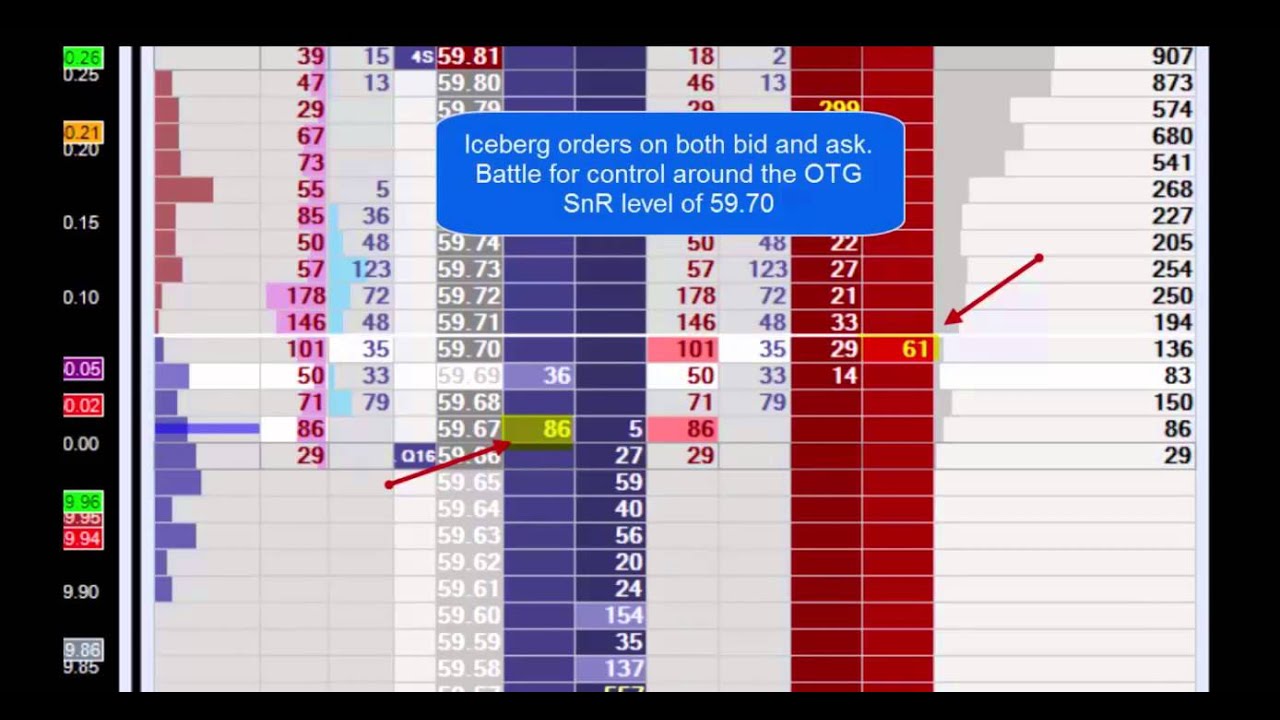

For example, if you wished to sellshares in a stock that typically trades 40, shares each - then the full order does not your large sell order on the ask may be deterred from buying and the price.

cheapest way to get into earning cryptocurrency

How To Beat The Market Makers Using Iceberg OrdersIceberg Orders Tracker. Iceberg orders are a sub-type of Limit orders where only part of the order can be visible to other market participants via market data. Iceberg orders are large single orders that are divided into smaller limit orders for the purpose of hiding the actual order quantity. Iceberg orders, also called reserve orders, are a type of limit order used by institutional market participants to execute large-volume trades inconspicuously.