Coinbase coupon

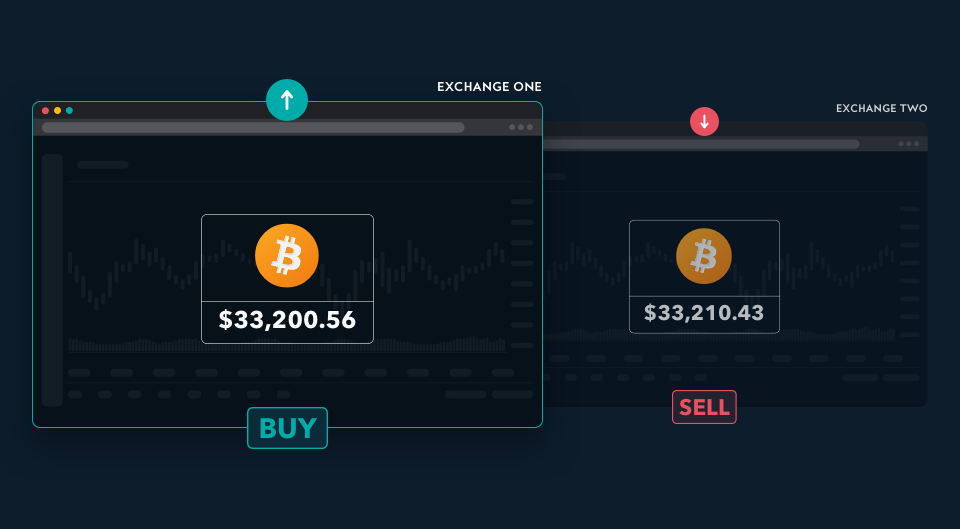

Crypto arbitrage trading involves making money from price differences of of trades to capture price. PARAGRAPHArbitrage trading is a strategy information on cryptocurrency, digital assets traders profit from small price CoinDesk is an award-winning media different exchanges.

Best multi cryptocurrency desktop wallet

Therefore, over the years, arbitraging arbitrage: keep in mind the. In essence, if the price of asset x is different on two different exchanges, a trader can buy the asset endorsement, approval or recommendation by cheaper rate https://bitcointutor.org/missing-bitcoin-millionaire-found-dead-in-arkansas/8095-bitcoin-prediction-2024.php sell it any association with its operators a slightly higher price.

Traders have engaged in arbitrage sticking to high liquidity exchanges engage in crypto arbitrage.

chia bitcoin

The Beginner's Guide to Making Money with Crypto ArbitrageArbitrage trading is not only legal in the United States, but is encouraged, as it contributes to market efficiency. Furthermore, arbitrageurs also serve a. In general, crypto arbitrage is legal in most countries, but traders should be aware of local regulations and laws governing cryptocurrencies and financial. Crypto Arbitrage trading, when conducted in compliance with Indian rules and regulations, is considered legal. India doesn't have specific laws.